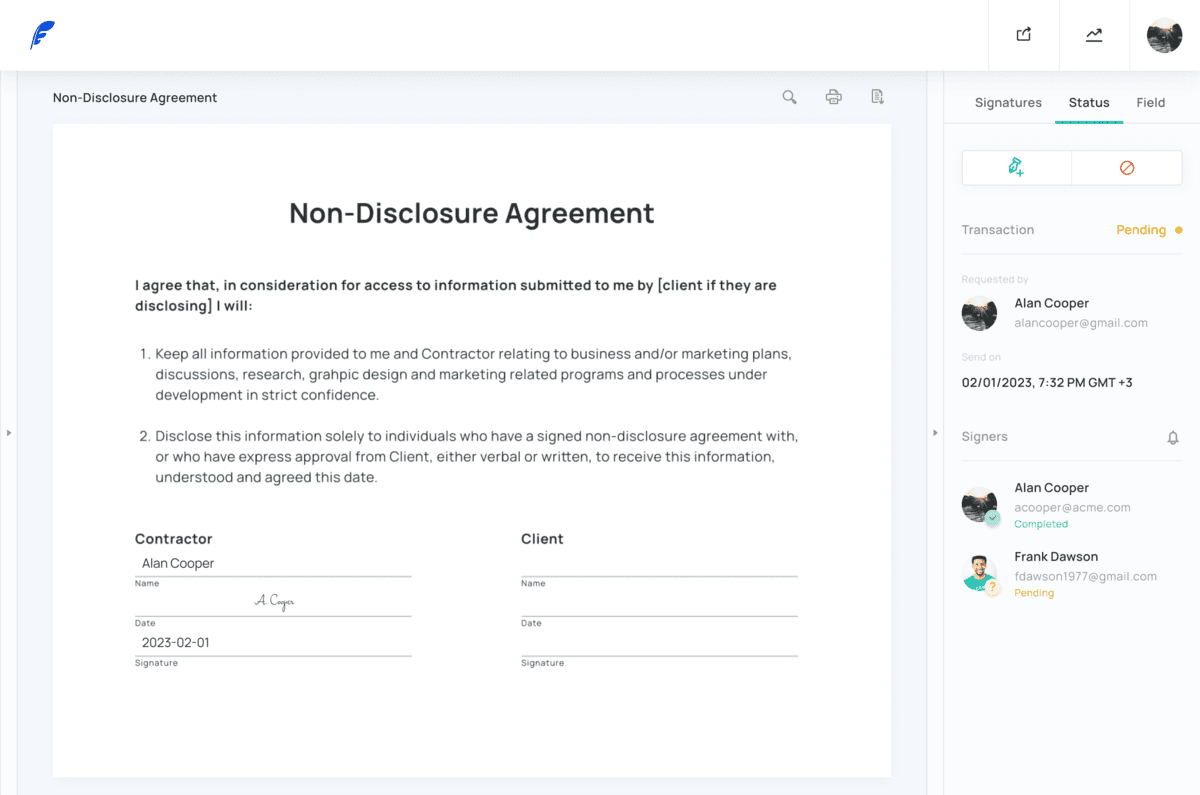

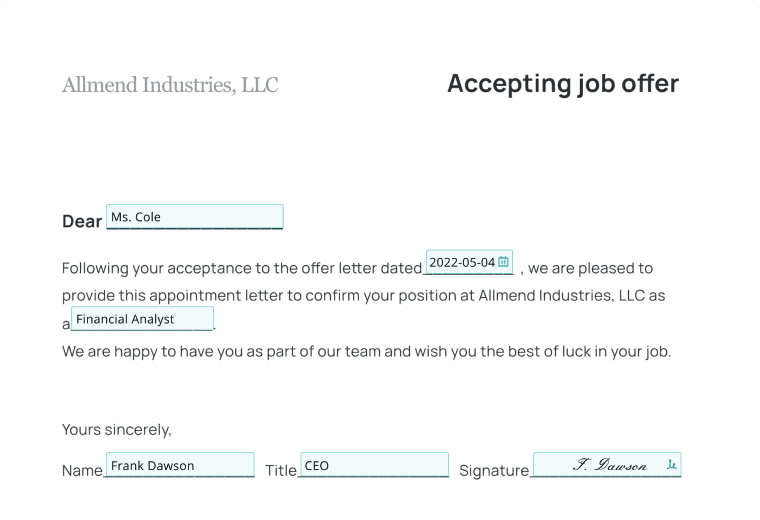

Sign with confidence.

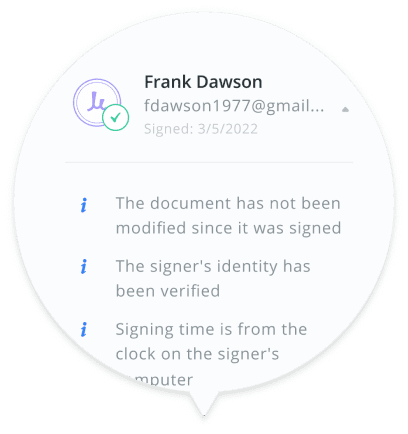

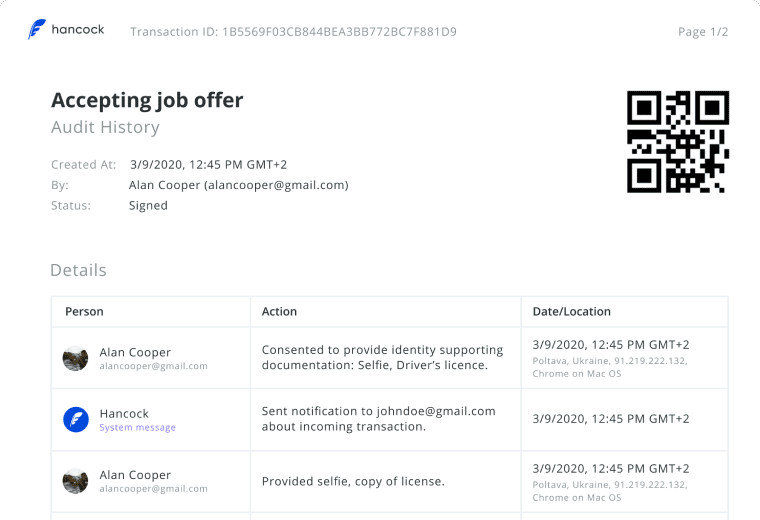

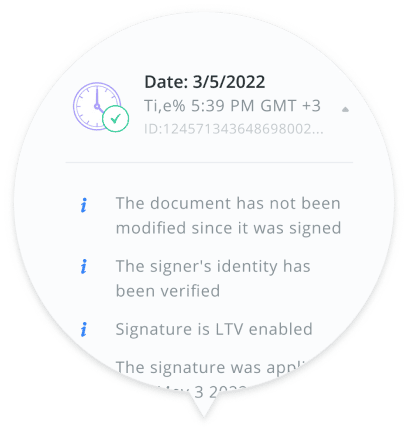

Cryptographically signed

Every document is signed with a unique cryptographic key that represents that specific user.

Cryptographically timestamped

The audit trail is then timestamped by us so that our observations about the signing can be verified independently.